Are you feeling overwhelmed by mounting debt? You're not alone. Many individuals battle the challenge of debt, but it doesn't have to control your life. With expert resolution strategies and a focused plan, you can manage your finances and work towards a brighter financial future.

- Professional advisors provide personalized guidance to help you develop a debt reduction plan that meets your unique needs and situation.

- We offer a range of options, including debt consolidation, settlement, and debt management plans.

- Taking the first step towards financial stability can be daunting, but with our support, you can realize your goals and establish a solid foundation for long-term financial prosperity.

Consolidate Your Debts and Simplify Your Finances

Feeling overwhelmed by a mountain of loans? It's frequent to feel this way when you're juggling multiple payments. But there's good news: consolidating your debts can be a powerful step towards financial freedom. By combining your credit card debt into a unified payment with reduced monthly amounts, you can simplify your finances and redirect your resources to other priorities.

- Think about a personal loan to gain financial control

- Create a budget to monitor your cash flow

- Seek a financial advisor for expert advice

Taking control of your financial situation can feel daunting, but remember that you don't have to go through this alone. There are tools available to help you build a brighter future

Achieve Financial Freedom Through Effective Debt Settlement

Unlocking financial freedom often requires a intelligent approach to managing your debt. Effective debt settlement is a powerful strategy that can drastically reduce your outstanding balances and put you on a path to financial liberation. By bargaining with your creditors, you can may reduce your overall debt amount, freeing up capital to invest in your future and achieve your financial goals.

- Effective debt settlement involves a in-depth evaluation of your current financial situation, including your income, expenses, and debt obligations.

- A qualified debt settlement professional can assist you through the process, developing a tailored plan to enhance your chances of success.

- While pursuing debt settlement, it's essential to remain focused to making punctual payments on your outstanding debts.

By arming yourself with Menopause and Joint Health the knowledge and tools of effective debt settlement, you can change your financial landscape and establish a brighter future.

Face Unmanageable Debt Collections: Dispute Resolution Services

Finding yourself burdened by unmanageable debt collections can be a alarming experience. Fortunately, there are resources available to aid you navigate this challenging situation. Dispute resolution services offer a powerful tool for tackling these concerns. These specialized services can analyze your debt collection statements, discover potential errors, and negotiate on your behalf to obtain a positive outcome.

- Key benefit of dispute resolution services is their knowledge in debt collection laws and regulations. They can confirm that your rights are protected throughout the process.

- Furthermore, these services can decrease the emotional stress associated with dealing with persistent debt collectors. They act as a intermediary, allowing you to concentrate on other areas of your life.

Explore dispute resolution services if you are dealing with a challenging debt collection situation. Engaging their guidance can enable you to gain control over your finances and strive for a secure future.

Get Out of Debt Faster: Customized Solutions for Every Situation

Feeling overwhelmed by financial obligation? You're not alone. Millions of people struggle with debt every day. The good news is that getting out of debt faster is achievable with the right plan. Our expert team offers tailored solutions designed to fit your unique situation. We understand that everyone's financial journey is different, so we take the time to listen your needs and create a plan that works for you.

- Develop a budget that tracks your income and costs

- Consider debt consolidation or balance transfer options to lower interest rates

- Converse with creditors to potentially reduce your monthly payments

- Build a plan for eradicating your debt, prioritizing high-interest accounts first

Don't let debt control your life any longer. Take the first step towards financial freedom by contacting us today for a free consultation. We'll work with you every step of the way to help you achieve your debt goals.

Say Goodbye to Stress: A Path to Debt Relief and Peace with Mind

Debt can be a heavy burden, weighing down not only your finances but also your peace mental mind. The constant worry and anxiety about bills can consume your thoughts and leave joy in everyday life. But there is hope! You don't have to continue stress to control your life. By taking steps to manage your debt, you can reclaim your financial well-being and find lasting peace with mind.

One of the first steps toward debt relief is creating a comprehensive budget. Track your income and expenses carefully to identify areas where you can save money. Consider seeking professional help from a financial advisor who can guide you through your process and create a personalized plan that addresses your needs.

Remember, you are not alone in this journey. There are resources available to assist you every step of the way. Don't be afraid to ask for help. By taking control of your finances and seeking support when needed, you can say goodbye to stress and achieve a brighter future.

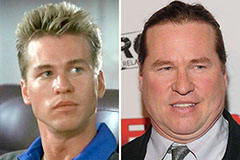

Val Kilmer Then & Now!

Val Kilmer Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!